COMMENTARY

Do You Know Where Your Tax Dollars Are?

By MARY MILLER

By MARY MILLER

Citizens for a

Better Eastern Shore

July 7, 2014

Counties around the state are finishing up their budgets for the next fiscal year. This is the time of year we can easily see where our county’s tax dollars are going – and take a look at similar expenses for the counties around us.

This year, and not for the first time, Northampton County wins the spendthrift award. Compared to Accomack County, and compared also to several eastern Virginia counties with similar populations, Northampton spends more per person for county administration, public safety and debt service, and provides more education dollars per student than most of the others. Northampton also tops the list in per-person local tax revenue collected.

When comparing expenses of the two Eastern Shore counties with a disparity of population (Accomack’s population is about three times Northampton’s), it’s more informative to compare the costs for what are assumed to be similar services on a per-person basis. For instance, Northampton collects almost $1,700 in local tax revenue per person, while Accomack collects about $1,100. Assuming that the actual costs of several locally funded services are similar from one county to the next, it would be logical that the same costs spread over a larger population would make the services less costly per person. All things being equal, one might assume that the total costs for many services in Accomack could be as much as three times as much as in Northampton, which has one-third the number of residents.

CONTINUED FROM FIRST PAGE

But what if the assumption of costs for similar services is inaccurate? Debt service has been an oppressive burden to Northampton taxpayers since the massive building projects – a new courthouse, regional jail, landfill closure and county administration building makeover – began over 15 years ago. Even though Accomack’s total annual debt service is greater, Northampton’s cost per person for debt service is nearly twice as much as Accomack’s. The same is true for Public Safety and Jail operation – the annual per capita costs are more than double for Northampton residents over Accomack’s. The state Auditor of Public Accounts publishes detailed annual reports of county and city revenues and expenses, and those reports indicate that the day to day costs of running county administration offices, which are locally funded, costs 30%-40% more per person in Northampton than in Accomack, to provide similar services to one-third the population.

The Northampton County’s debt currently stands at almost $30 million. Not much can be done to reduce the county’s recurring costs of debt service – except, perhaps, decide not to incur further debt without a public referendum. Nor can Public Safety costs be easily reduced – likewise, cutting costs for operating the regional jail (“regional” in name only, since Accomack County neither uses it nor contributes to its operational expenses). Those fixed costs eat up a lot of the local tax revenue collected – and those costs restrict the dollars available for community services.

Northampton collects more than enough local taxes ($20,195,116) to provide adequate services to a population of 12,089, but so much of that local tax revenue is spent to pay interest and principal on the long term debt for construction projects and for the state mandate to keep the half-empty regional jail fully staffed and operational that other services suffer. However, a closer look at Northampton’s budget figures – at dollars spent on county administration and at dollars allocated, or not, to community services – might provide more understanding of how the county frequently spends more than other small counties on similar expenses.

Staff costs and benefits

The biggest allocation for most entities, public or private, is personnel – wages and benefits, which can equal more than 30% of the base salary and may include Health & Dental Insurance, FICA/Medicare, Retirement, Life Insurance, Unemployment and Worker’s Compensation, bonuses and travel allowances, etc. Costs of operations for Virginia elected constitutional officers are subsidized by the Commonwealth through the State Compensation Board and, therefore, only part of those personnel and operational expenses are funded at the local level. But for local government personnel, the budgets for administration departments and employees come entirely from local taxes, and usually relate to the population of the locality – costs of similar services in each locality are linked to the number of people served. So when The Virginian-Pilot began publishing employee salaries of major, high population Hampton Roads cities, some on the east side of the Bay took notice.

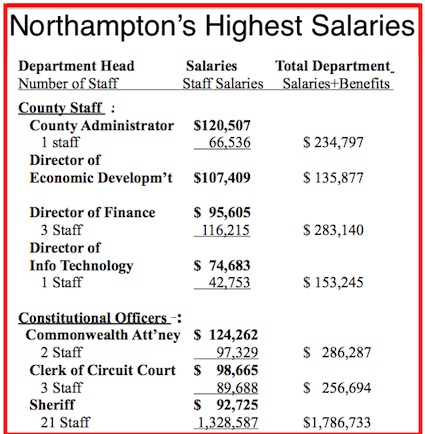

The cities of Portsmouth, Chesapeake and Virginia Beach have 8 to 40 times the populations of Northampton. They provide the same basic administration services the county does. Most of the big city salaries for directors of these basic services – Zoning Administration, Public Works, Human Resources, Emergency Medical Services (EMS) and Parks and Recreation – are between two and four times the salaries for the same positions in Northampton County. However, there are some noteworthy exceptions: Economic Development Director, Information Technology Director, and Finance Director. These positions here, serving about 12,000 residents, receive Northampton County salaries which are only 25-35% below the salaries paid for the same positions in Hampton Roads cities – each with 100,000 to 450,000 residents.

Salaries or services – establishing priorities

Some Northampton County staff has been reduced through retirements and attrition, yet in mid-May the county was advertising to fill positions. A 1.5% “Bonus to Employees” is contingent upon state budget passage. No employee raises were included in this year’s budget, but the public hearing presentation included the information that county employee’s health insurance was increasing by 10%, and that the county would be funding the entire increase. According to the Virginia Employment Commission’s May Community Profiles, the average weekly wage for local government employees in Northampton is $703 (see table) while the private sector average weekly wage is $547. In Accomack, the average weekly wage for local government employees is $619, while the private sector is $630 per week.

During Northampton’s budget preparations by the county staff, many reductions were made to requests by county departments, EMS, local fire companies and other community interests, for personnel, supplies, operations and equipment. While some adjustments were small and not likely to cause much pain, such as a reduction of $149 in a service contract – others could contribute to life threatening crises, such as deletion of $91,883 for two new EMS positions, deleting $8,394 from the ES Coalition Against Domestic Violence – and others are simply removing funds from enjoyable community activities, such as a fireworks display or a refinished gym floor. But major salary or benefits adjustments did not appear to be part of the budget balancing act.

Public input – is it needed?

When considering salary versus services priorities, there does not appear to be a forum for public discussion of those priorities. The county might be well served by public discussion of what a small rural county can comfortably afford to pay for county administration and services.

The public, the taxpayers who pay the bills, have virtually no input into the creation of a locality’s annual budget. And judging from the process and public meeting discussions, elected officials, at least in Northampton, appeared to have had little input. The budget was advertised as required, a brief synopsis of the $42,000,000 budget was printed, and both the Board of Supervisors and the public were presented with a nearly completed budget document by the County Administrator. The budget documents contained a 132-page budget, a 48-page PowerPoint presentation, and an 88-page wages, salaries and benefits spreadsheet. Public comment at the required public hearing was limited and reflected very specific concerns about allocations.

Would the budget have been any different if the taxpayers had been involved in the process? Perhaps Town Hall meetings by the elected Board of Supervisors would be a good place to start discussions about how the community wants its tax dollars spent before the next budget appears.

Reprinted by permission from the June 2014 edition of Shore Line. CLICK for CBES website. Submissions to COMMENTARY are welcome on any subject relevant to Cape Charles. Opinions expressed are those of the writer and not necessarily of this publication.

I live in Virginia Beach and as a native of Northampton County the salaries these employees receive is OUTRAGEOUS! We have over 440,000 residents here, based on an early 2014 census, and Northampton County has 12,408 residents. Might I also add that Northampton’s population dropped 5.23% since 2000.

I have compared employee salaries between Virginia Beach and Northampton County and there is not much difference in pay! However, the employees in Virginia Beach EARN their salaries due to all of the people they serve, but it seems that the employees of Northampton County are simply ENTITLED/GIVEN their pay. Also, the population has declined; did the county’s salaries reflect the drop? I doubt it! Lastly, the cost of living in Northampton County is 1.70% lower than the US Average.

All citizens need to wake up and find their voice. Their money is simply going into someone else’s pocket! This isn’t limited to just the Federal levels of government! I encourage all who read this article and my comment to view the Virginia Beach current annual budget and previous annual budgets since 2006 at: http://www.vbgov.com/government/departments/budget-office-management-services/budget-archives/pages/default.aspx

Elected County Supervisors led by Mr. Tankard made this skyrocketing budget happen in the first place — no jobs, no growth, and a selected group not paying real estate taxes. We lost the hospital, we lost businesses, and we lose our brightest students after they graduate from high school and take their talents elsewhere due to no jobs for them. The school board gave the county underpaid teachers, low test scores, and loss of the middle school. [CBES and Shoreline] are too conservative, with a “shut the door and let nobody in” policy. They controlled the making of the county’s Comprehensive Plan of “no growth.” It’s time they go into the trenches of Northampton County and see that all is not pristine.

I have lived in Northampton for over 50 years. I am embarrassed over the posting of “Northampton’s Highest Salaries”! Why the need for so many positions? There is no economic growth in our County. Why do we need an Economic Development Director with an annual salary and benefits of over $135,000? Every business that was vital to our County is gone or is leaving! Namely, the Hospital. What do we have here that attracts anyone? Our schools are in disrepair and we have no money to fix them or build new ones. All of our tax money is going to pay off the debt connected to the new Courthouse, the Regional Jail, all the perks and plusses for the remodeled County Administration building, and the high salaries for all the personnel necessary to run a county with a little over 12,000 residents.

It is amazing to me how a county that is so poor and so lacking in growth pays salaries far higher than those paid in counties and cities elsewhere in the state with significantly more population than Northampton County. Perhaps the answer is to clean house and eliminate the unnecessary jobs, not continue to create more.

Apparently in Northampton County a fancy title earns you a fancy salary too! Wake up Northampton County! Obviously, the need for prioritizing is NOW!

Why is the Sheriff’s salary so far down on that list of those county employees? He’s out keeping the county safe whenever, wherever he’s needed. The rest of that big salary county crowd sit in their air conditioned fancy new offices and soak up our tax dollars.

Our Sheriff’s Department deserves every penny it receives, and the Sherriff’s salary is earned by virtue of the time he has spent with the department and the responsibilities he has in that position.

I think the whole point of Mr Roberts’ comment was NOT about the Sheriff’s competitive salary at all. I think he was asking why the Sheriff is paid so much less than the county administration people who don’t seem to take responsibility for much of anything.

The salaries of the Constitutional Officers are set by the State Compensation Board on a scale based upon the total population served so any discussion needs to keep that in mind.

Good to see so many interesting comments about this reprinted article. To respond to the most recent comment — information about the role of the State Compensation Board regarding salaries for Constitutional Officers is included in the article, and those elected officials are listed separately in the graphic. Other county positions and salaries are created at the discretion of the Board of Supervisors. Those positions are not required by the State — the salaries and duties are set by the local Supervisors and funded by county taxpayers.