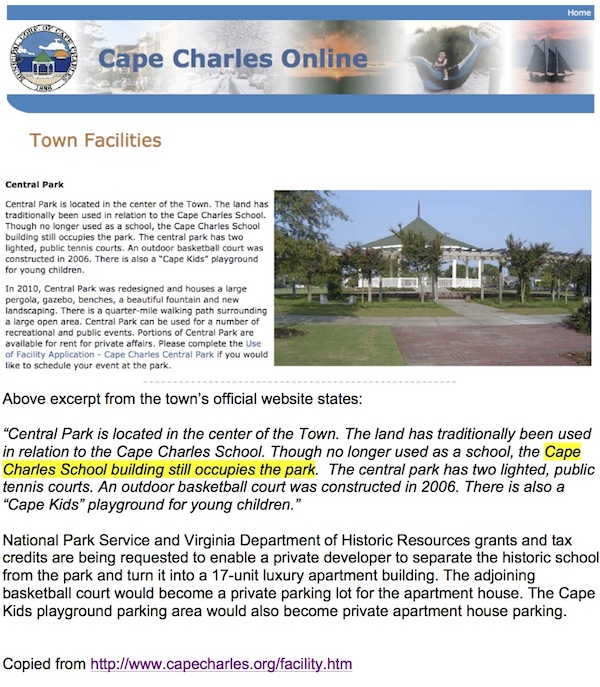

Old School Group Protests Tax Credits to Remove Parkland

The Town of Cape Charles official website above states: “the Cape Charles school building still occupies the park.” Old School Cape Charles, LLC, has sent the above printout to Richmond, asking why the National Park Service would enable a portion of Central Park, including the school, basketball court, and parking area, to be converted to an apartment building.

By GEORGE SOUTHERN

Cape Charles Wave

October 19, 2012

Old School Cape Charles, LLC, the group fighting to save the school in Central Park from becoming an apartment building, has launched a new frontal attack: tax credits.

The would-be apartment developers, Echelon Resources, Inc., have always maintained they will not take ownership of the school until the Virginia Department of Historic Resources approves their application for tax credits.

Echelon hopes to receive a 45 percent rebate of its expenses to remodel the school into apartments — 20 percent from the federal government and 25 percent from the state of Virginia.

That rebate would come from tax credits “syndicated” with investors operating other profitable enterprises. Investors in the Echelon project could use the credits to pay taxes on their other businesses.

Both the federal and state tax credit approval process is managed by the Virginia Department of Historic Resources in Richmond.

Historic Resources Department Director Kathleen Kilpatrick informed the Old School group October 5 that

“. . . neither the Department nor the National Park Service have authority to deny credits if a legal applicant fully meets the requirements of the program as set forth in law and regulations.”

So Old School has set out to document why Echelon Resources fails to meet the “requirements of the program.”

(CONTINUED FROM FIRST PAGE)

Old School spokesperson Deborah Bender noted in an October 15 letter to Director Kilpatrick that the Secretary of the Interior’s Historic Guidelines state:

(1) A property shall be used for its historic purpose or be placed in a new use that requires minimal change to the defining characteristics of the building and its site and environment.

(2) The historic character of a property shall be retained and preserved. The removal of historic materials or alteration of features and spaces that characterize a property shall be avoided.

“The school has always been part of Central Park, and until August 23, 2012, was zoned “Open Space,” along with the rest of Central Park,” Bender wrote, and attached a printout from the Town of Cape Charles official website stating that the school “occupies the park.”

(The printout is reproduced in condensed form at the top of this story. The Town website may be accessed directly at http://www.capecharles.org/facility.htm.)

“The intent is to use State Rehabilitation Tax Credits to remove the school, the basketball court, and the playground parking lot from Central Park, and give it all to a private, for-profit developer to be converted into luxury “loft” apartments,” Bender continued.

“Obviously, using the property for luxury park apartments is far from its historic purpose as a public space. And converting the Town’s only basketball court into a private parking lot is a travesty when the National Park Service is the financial enabler,” Bender wrote.

Bender pointed out that the main feature of the school building is the auditorium, “which for over 90 years has been used as a public assembly space.”

She informed Kilpatrick that Echelon Resources intends to subdivide the school auditorium into two luxury private apartments, constituting a “drastic change to the defining characteristics of the building, and a huge alteration of space that characterizes the property.”

The letter includes a photo of the school auditorium taken in 2006 and reproduced below:

“The main feature of the school building is the auditorium, which for over 90 years has been used as a public assembly space. With its conversion to private property, the only public assembly space in the Town will be the fire station.” (Excerpt from letter to Department of Historic Resources)

Bender further noted that constructing a 17-unit apartment building in a single-family residential area violates the Town’s Comprehensive Plan. “Although the Town Council issued a conditional use permit for the apartment building, we are contesting that in court,” she wrote.

Copies of the letter were sent to Virgina Gov. Robert McDonnell, U.S. Rep. Scott Rigell, State Sen. Ralph Northam, Delegate Lynwood Lewis, and the Richmond Times-Dispatch.

One of the accompanying photos in Old School Cape Charles’ letter to the Department of Historic Resources.

DISCLOSURE: Cape Charles Wave staff members are also active in Old School Cape Charles. Every effort has been made to ensure that the above report accurately represents the facts of the case.

Good stuff. For two reasons: One, that there is this much passion in town regarding this issue. The public should actively hold our elected officials collective feet to the fire when making decisions such as this. Two, that Cape Charles Wave is there to document and communicate the news and events surrounding this issue.

I’ve said it before but an enlightened citizenry that maintains an active voice in their local government is a healthy, good thing and the glue that keeps a town such as Cape Charles vibrant and alive. Win or lose on this issue, the citizenry will eventually win, for elected officials are — elected — and can easily be voted out of office if they’re making decisions that go against the public interest.

Old School Cape Charles, keep fighting, and Cape Charles Wave, keep writing!