Old School Group Protests Tax Credits to Remove Parkland

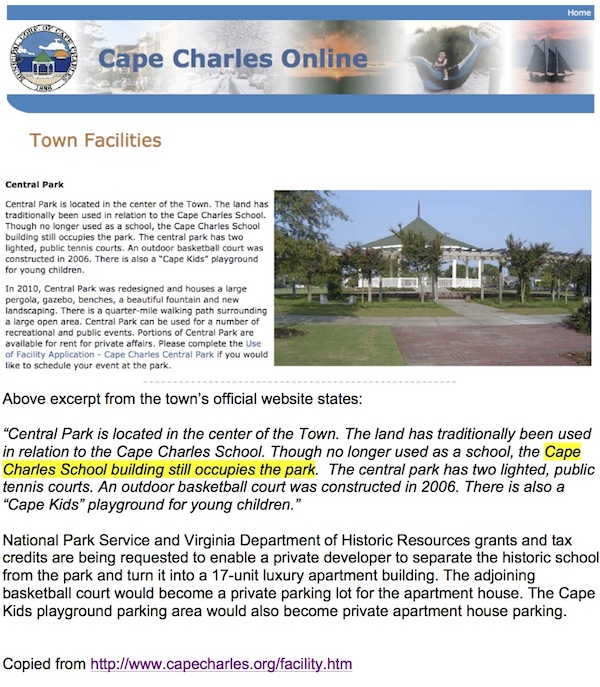

The Town of Cape Charles official website above states: “the Cape Charles school building still occupies the park.” Old School Cape Charles, LLC, has sent the above printout to Richmond, asking why the National Park Service would enable a portion of Central Park, including the school, basketball court, and parking area, to be converted to an apartment building.

By GEORGE SOUTHERN

Cape Charles Wave

October 19, 2012

Old School Cape Charles, LLC, the group fighting to save the school in Central Park from becoming an apartment building, has launched a new frontal attack: tax credits.

The would-be apartment developers, Echelon Resources, Inc., have always maintained they will not take ownership of the school until the Virginia Department of Historic Resources approves their application for tax credits.

Echelon hopes to receive a 45 percent rebate of its expenses to remodel the school into apartments — 20 percent from the federal government and 25 percent from the state of Virginia.

That rebate would come from tax credits “syndicated” with investors operating other profitable enterprises. Investors in the Echelon project could use the credits to pay taxes on their other businesses.

Both the federal and state tax credit approval process is managed by the Virginia Department of Historic Resources in Richmond.

Historic Resources Department Director Kathleen Kilpatrick informed the Old School group October 5 that

“. . . neither the Department nor the National Park Service have authority to deny credits if a legal applicant fully meets the requirements of the program as set forth in law and regulations.”

So Old School has set out to document why Echelon Resources fails to meet the “requirements of the program.” [Read more…]