Town Flood Insurance Rates Should See ‘Drastic’ Drop

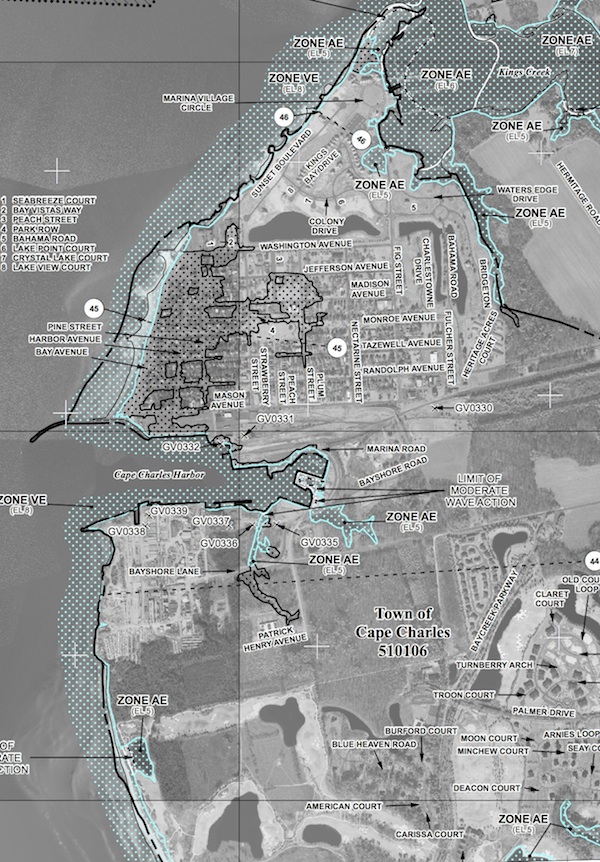

Click on map to view larger image. (An additional click may be required on larger image.) As proposed, only a few tiny areas in the entire Town of Cape Charles are classified “AE,” which requires flood insurance to obtain a mortgage. On the current 2008 flood map (not shown), a majority of the Historic District is classified “AE.”

By DORIE SOUTHERN

Cape Charles Wave

July 11, 2013

FEMA (Federal Emergency Management Agency) is proposing “a drastic change regarding flood zones in Cape Charles.”

Town Planner Rob Testerman told the Cape Charles Planning Commission July 9 that a majority of the Historic District, currently rated high-risk by FEMA, is proposed to be reclassified at a much lower risk of flooding.

That is wonderful news to any property owner paying flood insurance premiums.

Under FEMA rules, federally regulated lenders require property owners to buy flood insurance in areas labeled “A or “V” on the FEMA flood zone map.

In high-risk areas, there is at least a 1 in 4 chance of flooding during a 30-year period.

In the current 2008 FEMA map, “a majority of the historic portion of Cape Charles is located in the AE Zone,” Testerman said.

But the preliminary map for 2013 “shows the AE zone ending at the beach,“ he noted.

The most flood-prone area is of course the beach itself, which retains a “VE” classification.

CONTINUED FROM FIRST PAGE

FEMA eventually will post the proposed maps on the Internet. Meanwhile, Testerman has copies for the Cape Charles area, and Northampton County Planner Peter Stith has maps for the County.

Although property in the moderate- to low-risk areas (which on the proposed map describes most of Cape Charles), is not required to have flood insurance, it is still recommended.

Flood insurance rates are markedly less in lower-risk areas.

Government-regulated flood insurance (Click here for rate charts) for $250,000 coverage in the “A” zone has a minimum annual premium of $2,014.

But the same coverage in the lower-risk “X” zone can cost as little as $412.

Although flood insurance is provided by private companies, the rates are regulated by FEMA.

The proposed maps are being reviewed for “non-technical” errors such as street names. There will follow a 90-day appeal period, after which the new classifications and rates should be in effect.

Municipalities such as Cape Charles are allowed a further 6-month adoption period to amend flood zone ordinances.

I don’t have flood insurance, but my homeowners insurance shot up 34 percent. People like myself on fixed income will be feeling a lower standard of living. The less money we have, the less we will buy with no sales taxes for our local government. Watch for senior citizens to begin their exit and move to Florida where their pensions are not taxed. And I also heard in the scuttlebutt that the politicians are going to raise our real estate taxes — like the insurance companies picking our pockets clean. All of you politicians in Northampton County are not qualified to hold office if you cannot lower taxes, create non-government jobs, provide better education for our children, better teachers, better shopping with lower costs of goods, senior citizens centers, and give us old folks a hospital so we can have a better chance for survival. Please leave you egos home and do the job or get out of the way and let better people do it for you. I could show you how it’s done — next time vote for me!

Mr. Sacco are you going to run for town council or a county office?

This sounds like great news, and I would like to take advantage of it asap. Does anyone know when the insurance companies will “recognize” the new classifications? I know there will be a 30-day waiting period, no matter what. Will there be time to buy flood before the height of this hurricane season?

I paid off my mortgage by liquidating pretty much everything I owned. That allowed me to drop my flood insurance, which I could no longer afford on p/t salary, but I’m not happy about being left vulnerable as global warming continues to increase the number and violence of tropical storms.

As to Mr. Sacco’s point, Farm Bureau refused to renew my homeowners’ and now, like Mr. Sacco, I am now paying about 45% more per year. America’s biggest problem is that there isn’t much left for the rich to steal.

I happen to be a Virginia licensed insurance agent for the past 14 yrs. and there are options available for Cape Charles residents that may lower your homeowners insurance. Feel free to look me up on the web! Debbie Suddeth, Farmers Insurance

Pete, I think you missed the correct word according to Mr. Sacco. Your last line should read, “There isn’t much left for the current group of politicians to steal,” which may be far more accurate.

The best homeowners insurance deal by far is Mutual Assurance Society of Virginia, which we have used after Erie decided that they were no longer insuring the Shore. We paid approximately $2000 the first year and now, for Cape Charles, we pay about $700 yearly, while, for Richmond, we pay under $400 for a 3,000 sq. foot house in the Fan. We learned about it from neighbors: the insurance company replaced their slate roof, copper gutters, the works, restoring the house to its original magnificent state. Subsequently, I learned that many of my colleagues had this insurance.

The rich are not stealing; it’s the politicians that are stealing and blaming it on the rich. Enough already, most taxpayers are paying more than their fair share. The government wastes billions of our hard-earned tax dollars, giving benefits to individuals that are in the generational cycle of welfare and disability schemes and they don’t ever want it to change.

Unless I am missing something here, the good folks of Cape Charles should be clicking their heels celebrating FEMA’s flood reclassification. Those with flood insurance will pay much less and those without might actually be able to afford it.

Don’t get sidetracked with squawking about taxes on pensions and whatnot. This is great news for the town. Feel happy!